Brilliant Operating Income Statement Construction In Progress Balance Sheet Example

/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

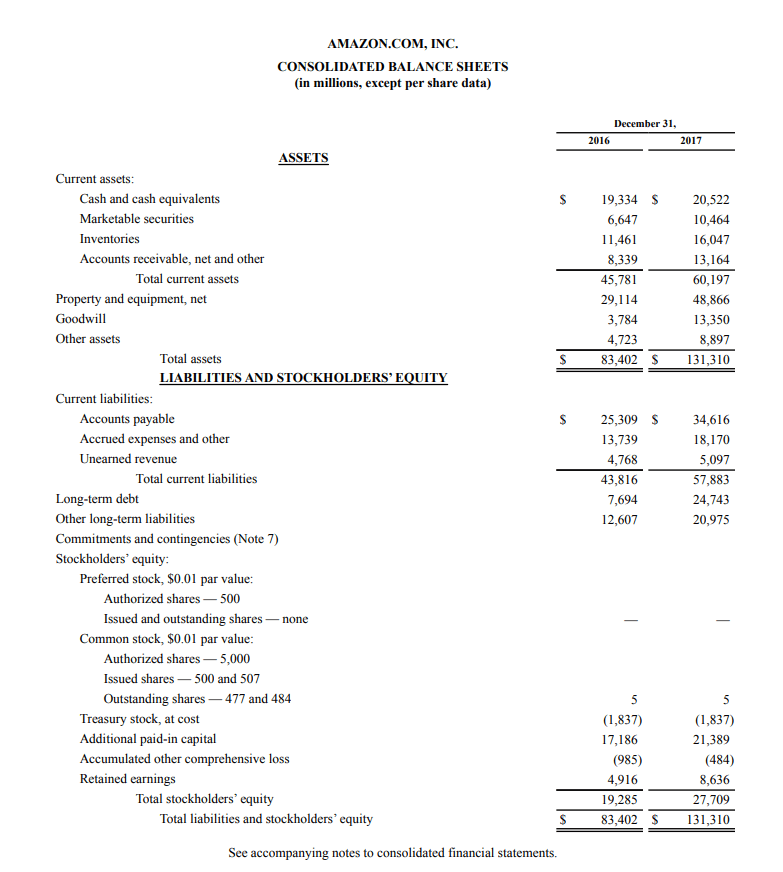

We have reviewed the accompanying balance sheet of XYZ Construction Co Inc.

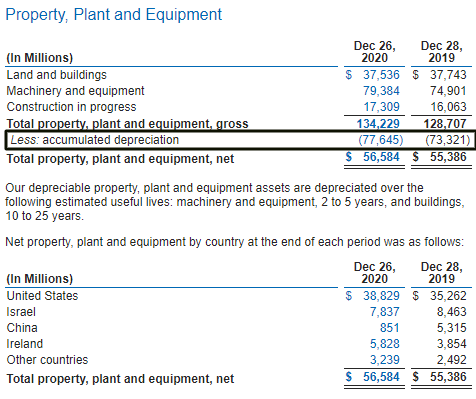

Operating income statement construction in progress balance sheet example. There are three formulas to calculate income from. If the business will the asset when it is complete it will be a fixed asset. Consequently capitalized interest included as part of an intermediarys construction work in progress on the balance sheet should be recognized on the current income statement as interest expense with a corresponding offset to allowance for borrowed funds used during construction.

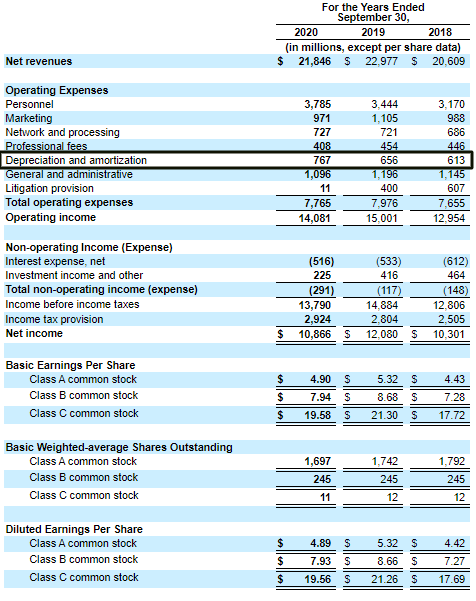

Net income loss 663752 386726 Adjustments to reconcile net income loss to. Fn 8 If neither period presented has a net loss the statement may be titled Consolidated Statement of Income fn 9 Upon adoption of FASB ASU No. Construction Accounting Introduction to Balance Sheet Format In most industries the balance sheets upper half has three distinct groupings of accounts.

As of December 3 1 20x1 and the related statements of income and retained earnings and cash flows for the year then ended in accordance with Statements on Standards for Accounting and Review Services issued by the American Institute of Certified Public Accountants. Construction Work-in-Progress is a noncurrent asset account in which the costs of constructing long-term fixed assets are recorded. Accounting for Construction in Process.

If the business is building assets under contract to sell they are inventory assets. Cash flows from operating activities. Discussed below in Example 4 the stand-alone Income Statement of a trading entity.

Income Statement Other Income Interest Income. 2016-02 operating lease expenses should be included in income from continuing operations in the income statement. The balance sheet and the income statement are two of the three major financial statements that small businesses prepare to report on their financial performance along with the cash flow statement.

The best format is a construction profit and loss statement identifying contract revenues. Interest expense interest income and other non-operational revenue sources are not considered in computing for operating income. If a company is constructing a major project such as a building assembly line etc the amounts spent on the project will be debited to a long-term asset account categorized as Construction Work-in-Progress.

/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)