Top Notch Investment In Subsidiary Ifrs

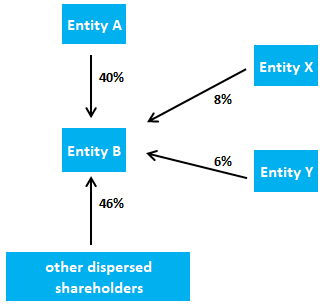

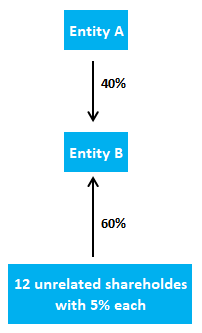

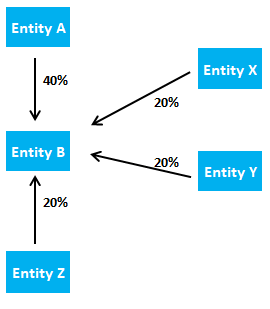

The control means that the parent company can govern the financial and operating policies of its subsidiaries to gain benefits from the operations of subsidiary.

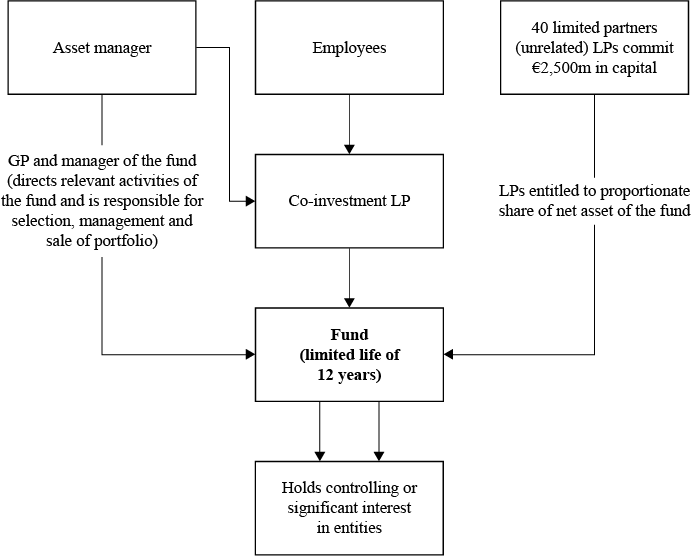

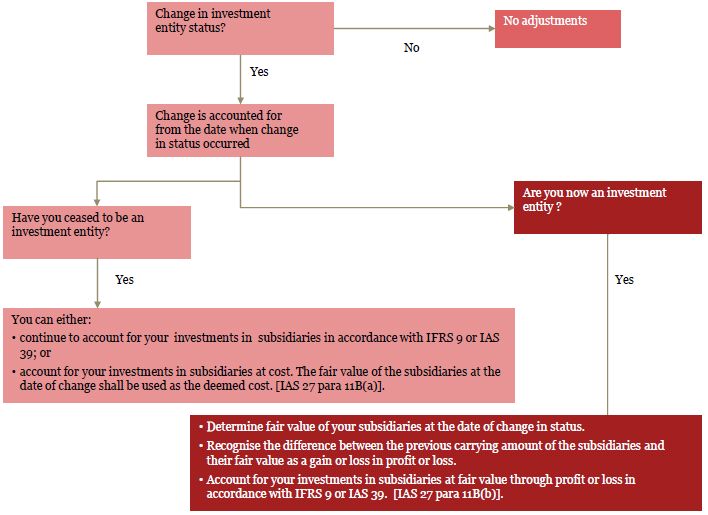

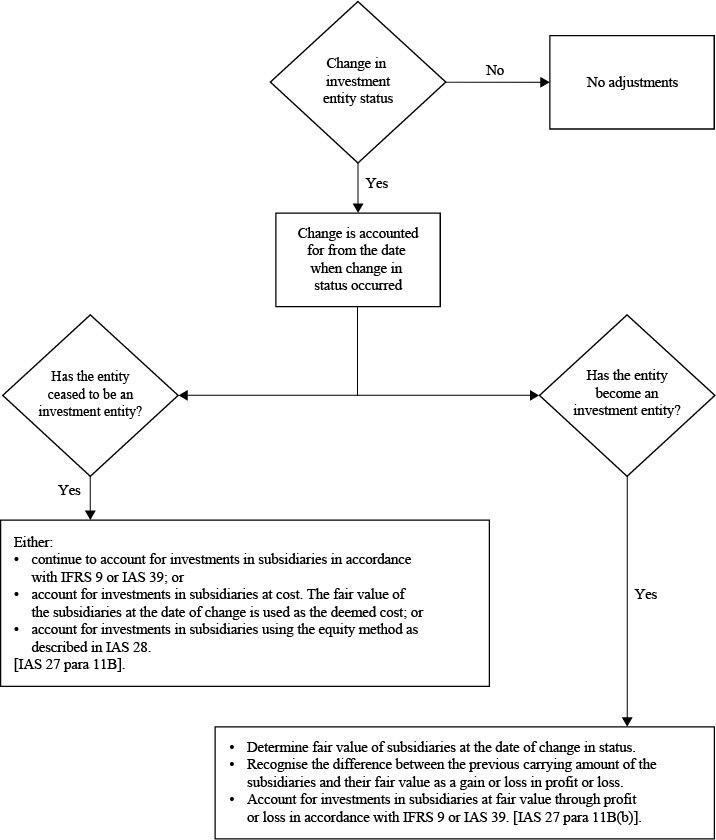

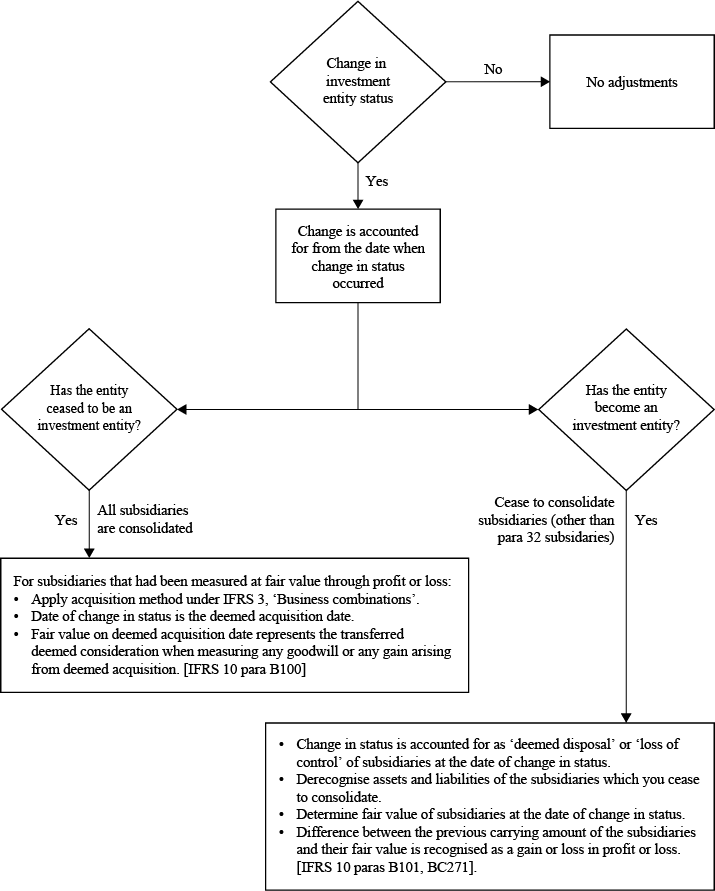

Investment in subsidiary ifrs. Subsidiary is an entity which is controlled by another entity. In December 2014 IAS 28 was amended by Investment Entities. An investment entity is required to measure an investment in a subsidiary at fair value through profit or loss in accordance with IFRS 9 Financial Instruments or IAS 39 Financial Instruments.

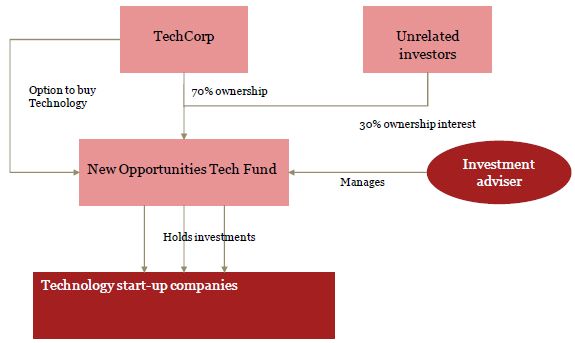

However if company A does not meet the definition of an investment entity the interest in a subsidiary is exempt from applying IFRS 9 in its separate financial statements. Entity investments in an investment fund are accounted for in accordance with IFRS 9. Under the newest IFRS 9 requirements we need to apply general 3-stage model to all loans no exception.

The investee is not an associate joint venture or subsidiary of the entity and accordingly the entity applies IFRS 9 Financial Instruments in accounting for its initial investment. Separate financial statements are covered in IAS 27 and are defined as financial statements in which investments in subsidiaries joint ventures and associates and accounted either at cost in accordance with IFRS 9 or using the equity method. Here is a summary guidance relating to investments in subsidiaries in consolidated accounts and as a start a short summary of all of the types of investments to put into perspective investments in subsidiaries.

At 31st December the subsidiary was in a liquidation process. Enjoy Free Price Alerts Market Analysis Tools. If an investment becomes a subsidiary the entity follows the guidance in IFRS 3 Business Combinations and IFRS 10 If any retained investment is held as a financial asset the entity applies IFRS 9 Financial Instruments and recognise in profit or loss the difference.

Impairment assessment requirements for investments in equity instruments because as indicated above they now can only be measured at FVPL or FVOCI without recycling of fair value changes to profit and loss. Investment entities defined in IFRS 10 Consolidated Financial Statements are required to measure some of their investments in subsidiaries at fair value through profit or loss in accordance with IFRS 9 IAS 39. In IFRS 10 Consolidated Financial Statements IFRS 11 Joint Arrangements and IFRS 12 Disclosures of interest in other entities all these types of investments are explained.

IFRS 9 para 21a. On the other hand IFRS 9 establishes a new approach for loans and receivables. Loans and receivables including short-term trade receivables.