Amazing Financial Statements With Adjustments Examples

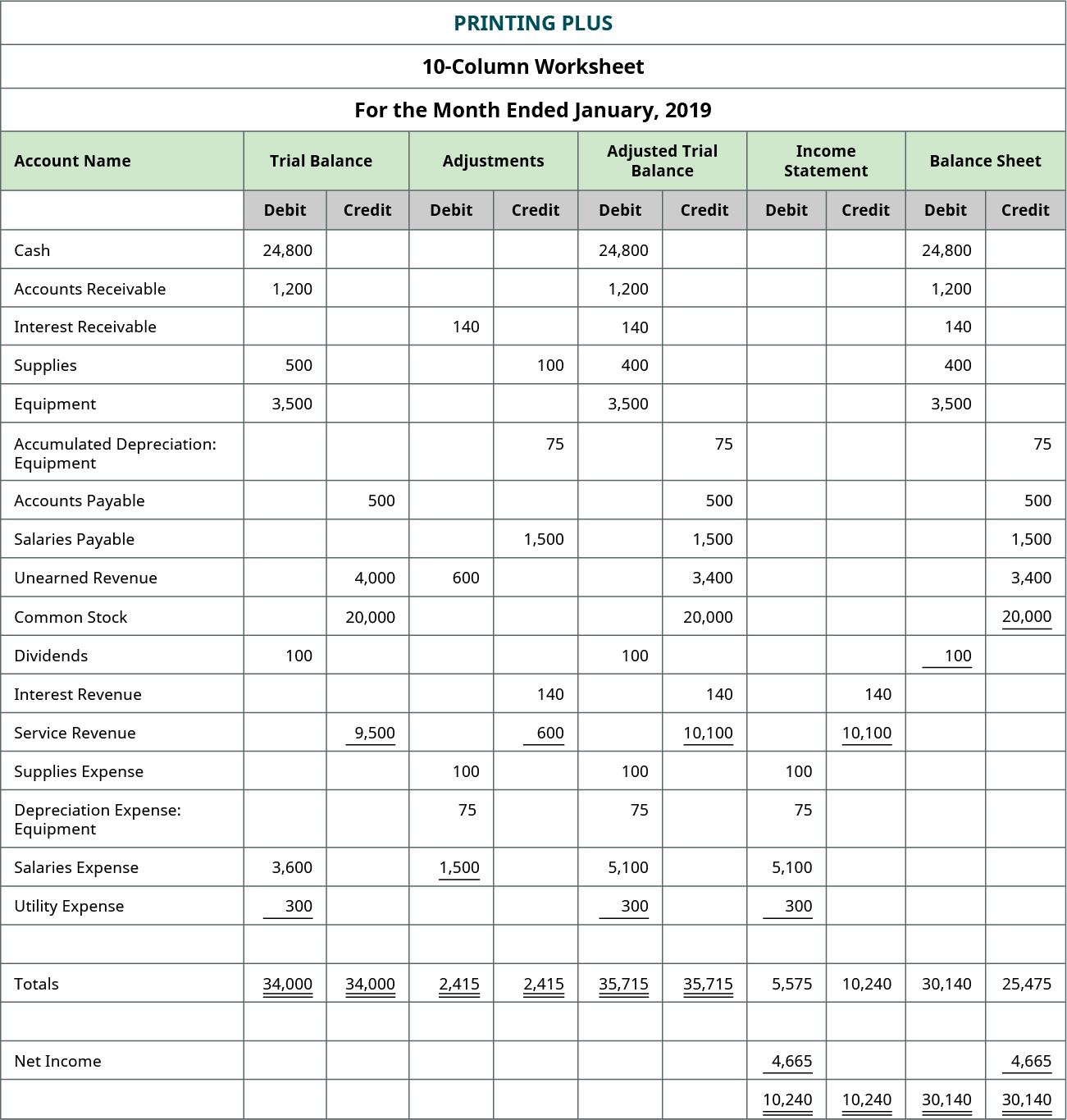

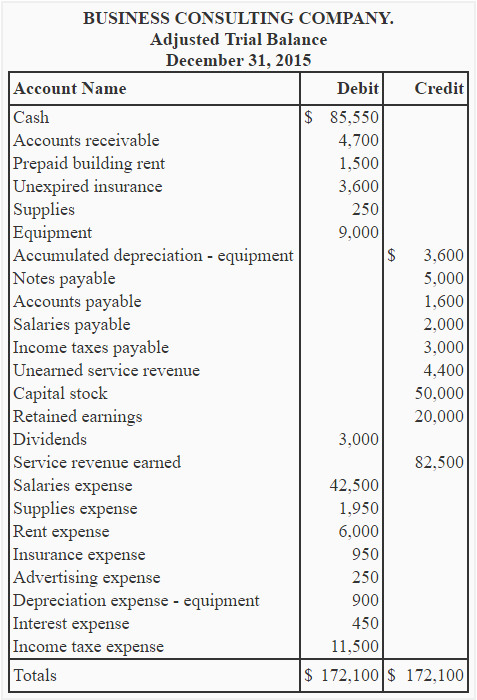

FINANCIAL STATEMENTS WITH ADJUSTMENTS You have learnt in the previous lesson how to prepare Trading Ac Profit Loss Ac and Balance Sheet.

Financial statements with adjustments examples. Adjusting Entries Example 1 Accrued but Unpaid Expenses Mr. Presentation of Financial Statements 231 V Example disclosures for entities that early adopt IFRS 9. Adjustments for outstanding Income Income may be due but not yet paid.

It is possible that the expenses given in the Trial Balance may not be the total expenses. Adjustments and Their Effect on Financial Statements. This is referred to accruedoutstanding income Accrued income is a current asset.

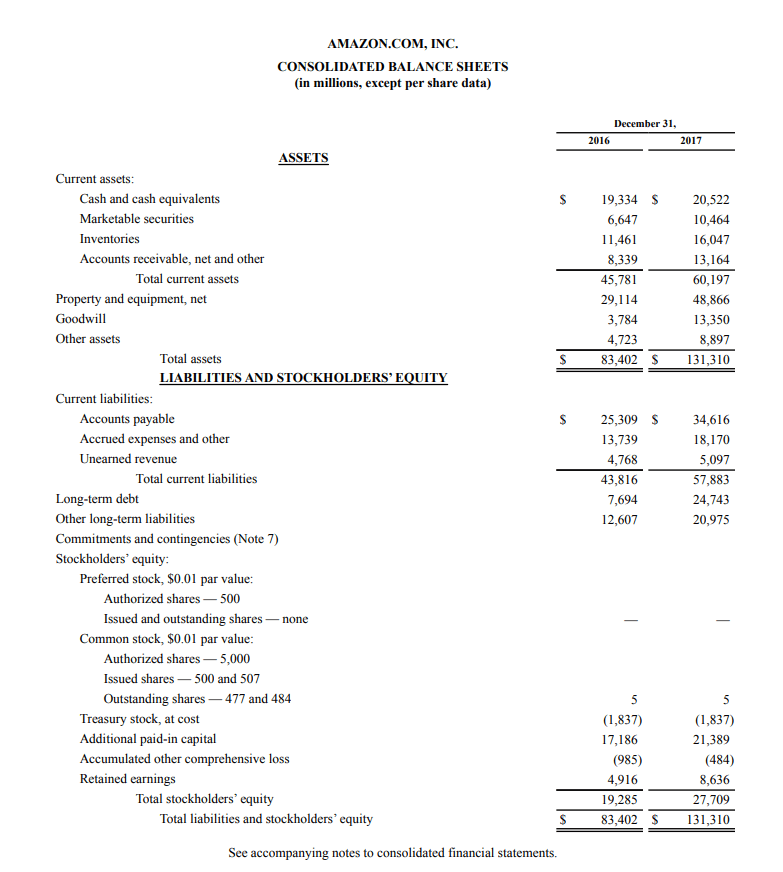

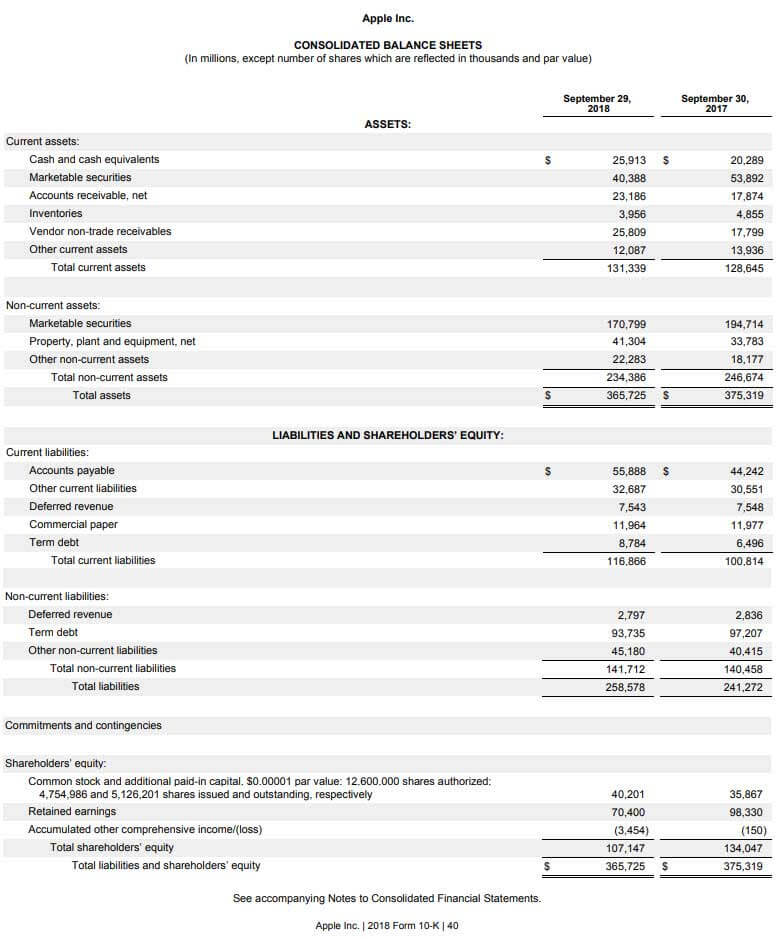

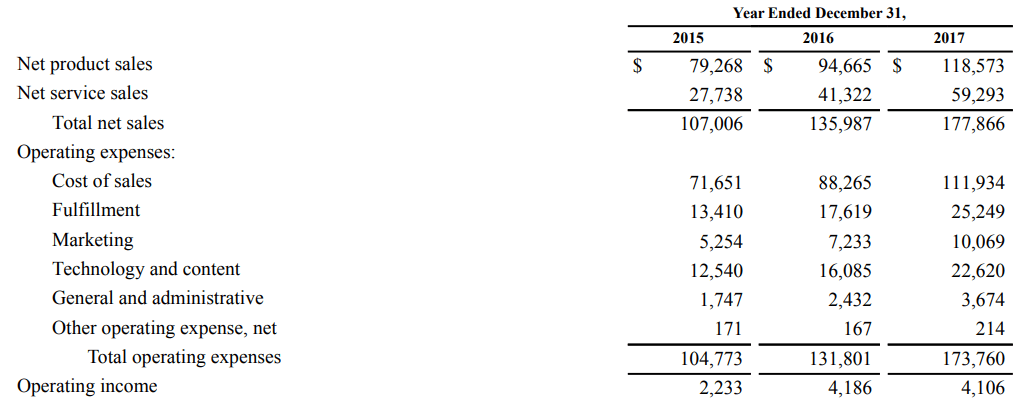

Non-standard adjustments tend to involve a higher degree of analytic judgment. The error was identified in the year 2018. Adjustments include those related to investments inventory property plant and equipment.

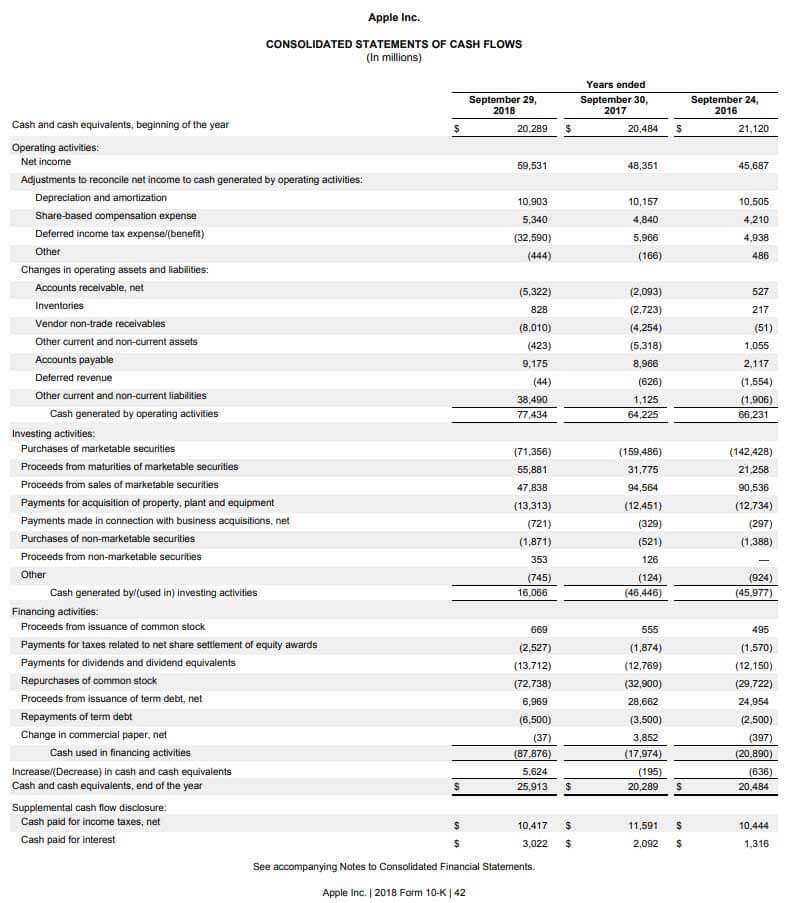

Financial Statements 2019 Example Financial Statements. 2 Article V section 501 of the typical loan agreement with such entities. Majority of the business enterprises are preparing their financial statements in statement form.

Over 2000 Essential Templates to Start Organize Manage Grow Your Business in 1 Place. Recognizing revenue that has not yet been billed. It is adjusted using the following entry Debit receivable account Credit income account Adjustments for outstanding Income Example 2 Firm XYZ is renting part of its building for TZS 600000.

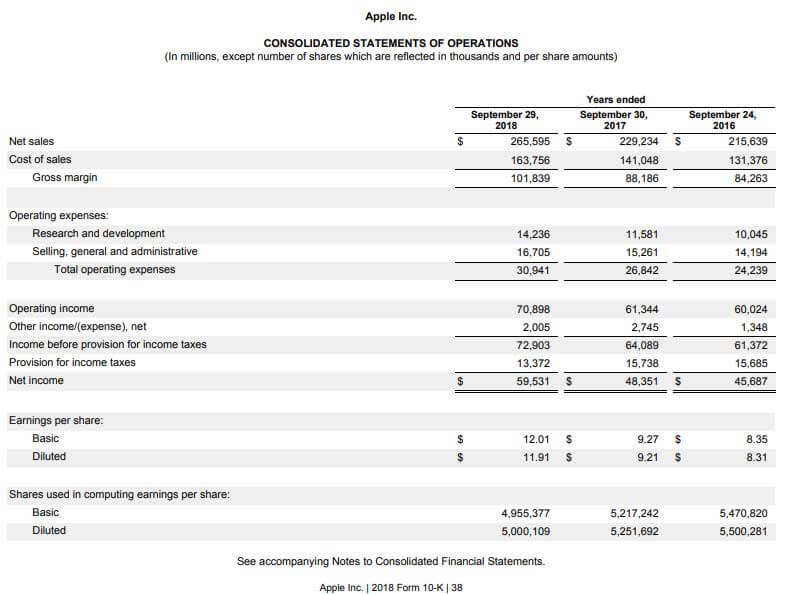

The 39000 depreciation charge for the year in the statement of profit or loss is reflected in the accumulated depreciation account. For example we may adjust financial statements to reflect estimates or assumptions that we believe are more suitable for credit analysis. Financial Statements 2018 Example Financial Statements.