First Class Profit And Loss Adjustment Account Format

This account is also prepared in T-form.

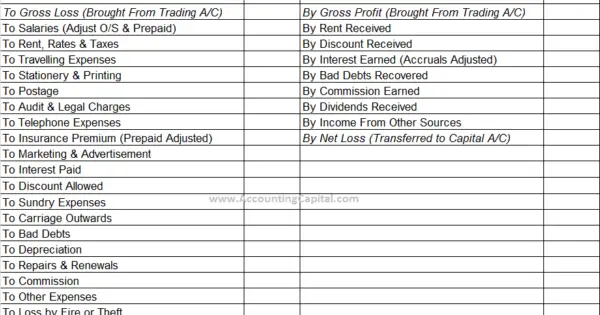

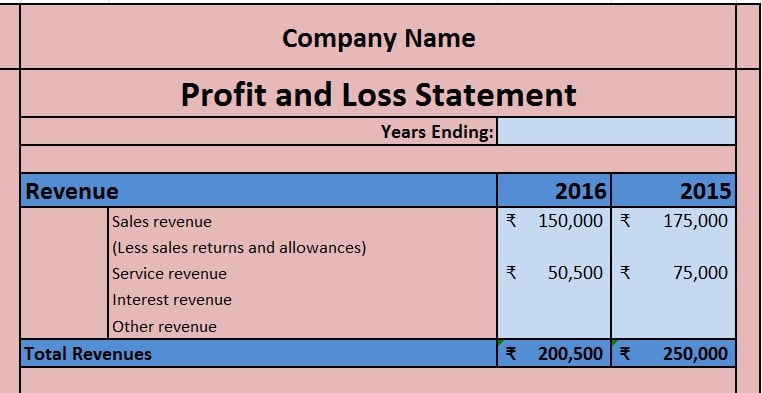

Profit and loss adjustment account format. It is prepared to find out the Net Profitloss of the business for the particular accounting period. Out of the above three statements trading profit loss accounts are prepared together and balance sheet is prepared independently. To Capital Ac Being net profit transferred 4.

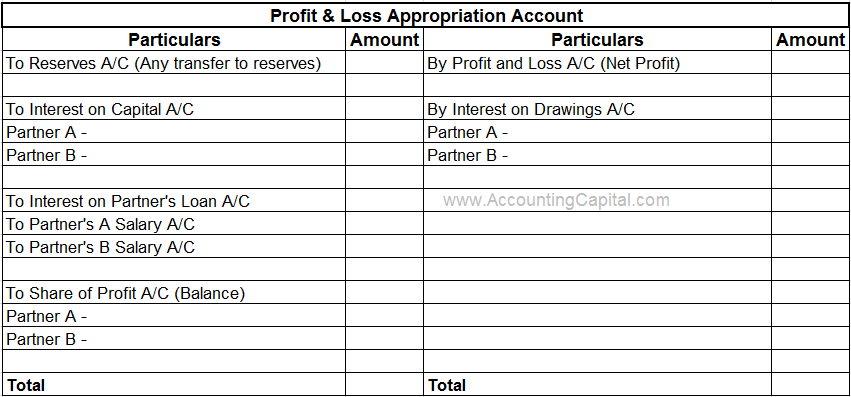

Apart from the usual items of gains incomes losses and expenses which will appear in the profit and loss accounts of both the holding and the subsidiary companies and which will therefore be aggregated some adjustments will be required. Under this method we make up an account by name Adjusted Profit and Loss ac posting the Net Profit along with all the postings representing losses gains appropriations and adjustments. It shows how the profits are appropriated or distributed among the partners.

The monthly profit and loss template is perfect for small medium and large businesses as it can easily be adjusted to add or eliminate detail as required. After finding out the gross profit gross loss by preparing the Trading Account Profit and Loss Account is prepared to find out the net profit net loss of the business during an accounting year. The first time the entry will be recordedaddited in trading account or profit and loss account and the second time the same item will be recordedaddited in the budget sheet.

Purpose For knowing the gross profit or gross loss of a business. Profit and Loss Appropriation Account is merely an extension of the Profit and Loss Account of the firm. Ie 1 profit and loss adjustment account T format or 2 statement format.

The net balance in the Profit and Loss adjustment ac indicates the net effect of all such rectifications pertaining to the past periods. It starts with the net profitnet loss as per Profit and Loss Account. The following are the most important.

The Manufacturing Account format must show the quantities and values. In case of profit. The stock on 21st December 1991 was valued at 25000.